10 Takeaways from San Mateo County’s Housing Market – June 2025

- Peyman Yousefi

- Jun 11, 2025

- 13 min read

The June 2025 housing report for San Mateo County paints a complex picture of a market in transition. While national headlines often highlight mortgage rates and inflation trends, the true story of real estate is always local—and in San Mateo, that story is about normalization.

After years of rapid price appreciation fueled by pandemic-era demand and stock market wealth, the local market is showing signs of cooling. But it’s a very specific kind of cooling—marked by slower momentum, rising inventory, and more selective buyers. Prices are holding near record highs, especially for detached homes and luxury properties, but the pace has shifted.

In this post, I break down the 10 most important trends from the latest San Mateo County data, based entirely on local numbers. These insights will help you understand what’s happening right now in this market, and what it means if you're thinking about buying, selling, or investing in San Mateo real estate. Before we dive in, the carousel below offers a quick visual snapshot of the 10 key takeaways.

Now, let’s dig deeper into what the data actually shows — and what it means for San Mateo’s housing market.

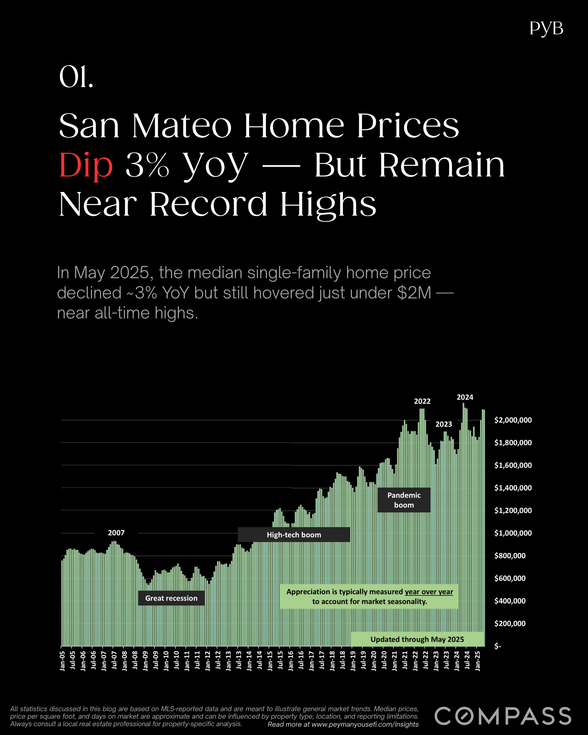

1. Home Prices Dip ~3% Year Over Year — But Stay Near Record Highs

In May 2025, the median sales price for single-family homes in San Mateo County declined approximately 3% compared to May 2024. This marks the first significant year-over-year price drop in the county since the peak of the pandemic housing boom. But while the market is no longer racing upward, prices remain historically elevated—hovering just below $2 million.

The data suggests a classic market plateau rather than a downturn. Prices peaked twice in recent years—once in early 2022 and again in late 2024—and are now stabilizing at high levels. The current softening reflects a market that’s adjusting to affordability ceilings, buyer caution, and broader economic crosscurrents, including high interest rates and volatile financial markets.

Importantly, this cooling is not uniform. While some segments—especially condos and mid-tier homes—are seeing more pricing pressure, the luxury and detached home markets are holding up more strongly. High-equity buyers continue to transact, but with more deliberation and less overbidding.

For sellers, this means realistic pricing is critical—gone are the days of automatic bidding wars on overpriced listings. For buyers, this cooling trend may open up more room to negotiate, particularly on homes that have lingered on the market. But don’t expect bargains across the board: desirable, move-in-ready homes in prime areas are still commanding strong prices.

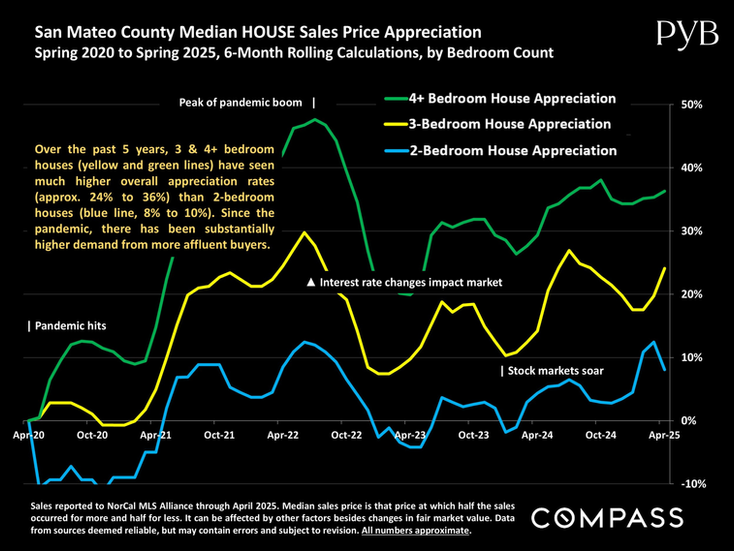

2. Larger Homes Lead the Market — 4+ Bedrooms Up 36% Since 2020

Over the past five years, larger homes with 4 or more bedrooms have clearly outperformed the rest of the San Mateo County market in terms of price appreciation. From Spring 2020 to Spring 2025, these homes appreciated by 36%, compared to 24% for 3-bedroom homes and only 8% to 10% for 2-bedroom homes.

This divergence began during the pandemic, when remote work reshaped what buyers prioritized. More space, home offices, multigenerational flexibility, and outdoor amenities became must-haves—not luxuries. But what’s striking is how this preference for space hasn’t faded. Instead, it has accelerated in the years since, particularly among high-income households with stock wealth and tech earnings.

Buyers in this segment tend to be in the “move-up” or luxury category, often using proceeds from prior sales, RSUs, or cash reserves to secure larger homes. That means they’re less affected by mortgage rate fluctuations and more focused on location, school districts, and long-term usability.

On the supply side, larger homes remain relatively scarce—especially in desirable areas like Hillsborough, Burlingame, San Carlos, and Menlo Park. Turnover is low, and new construction is limited. This tight supply, paired with resilient demand, is keeping upward pressure on pricing, even as the broader market cools.

For sellers of large homes, the market still offers strong pricing power—especially if the home is updated and well-presented. For buyers, particularly those moving up from smaller homes or condos, the widening price gap makes strategic timing and financial preparation more important than ever.

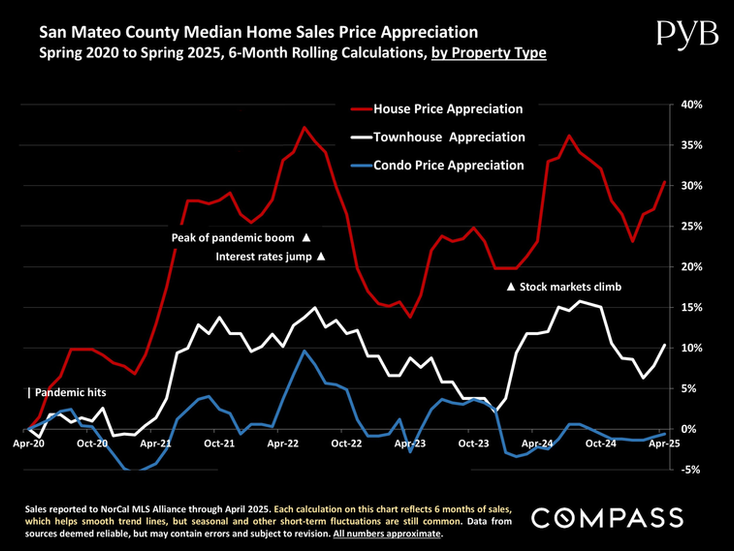

“San Mateo County Median HOUSE Sales Price Appreciation (by Bedroom Count)” and “San Mateo County Median Home Sales Price Appreciation (by Property Type)”

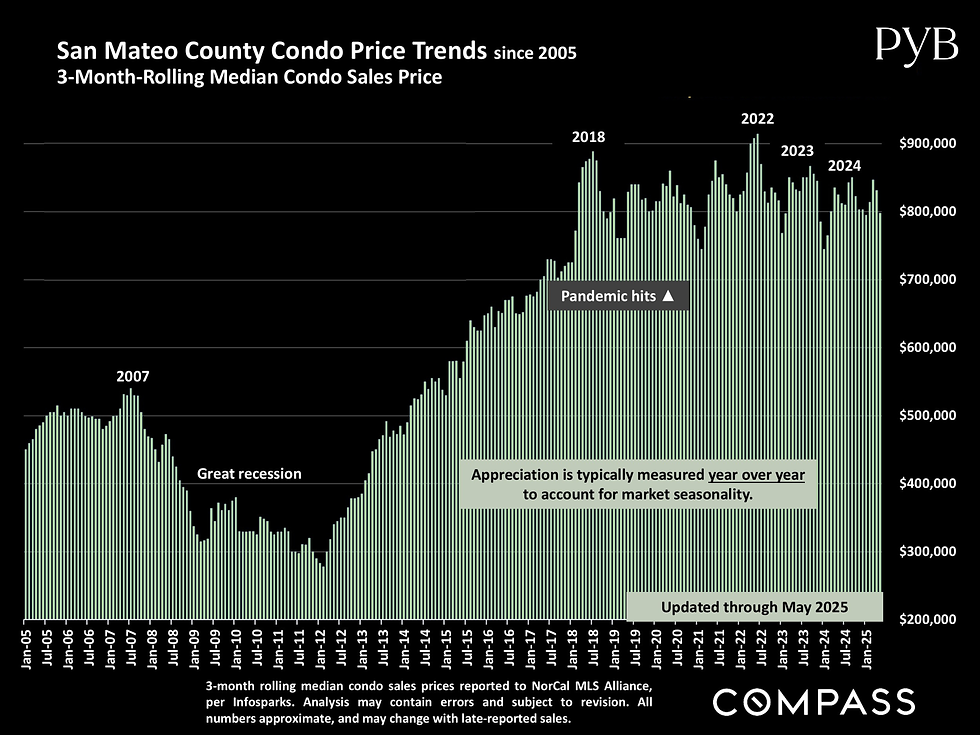

3. Condos Are Losing Steam — Prices Down 3% Year Over Year, and Up Only 5% Since 2020

Not all segments of San Mateo County’s housing market are holding up equally. Condos, in particular, are showing signs of fatigue. As of May 2025, the median condo price is down approximately 3% year over year, and over the past five years, values have increased by only about 5%—far below the gains seen in the single-family home market.

This underperformance is partly structural. Condos tend to attract first-time buyers, downsizers, or investors, all of whom are more sensitive to interest rate fluctuations and monthly cost burdens. In today’s high-rate environment, many buyers are hitting affordability ceilings—and rising HOA dues, insurance costs, and outdated amenities are making many condo purchases less attractive.

While well-located, modern, or turnkey condos are still seeing activity, the broader condo market is struggling with longer days on market, slower absorption, and more frequent price reductions. Demand is especially soft for older units, properties in less walkable locations, or buildings with deferred maintenance or high fees.

This makes condos the softest segment in the county right now—a sharp contrast to the resilience of the detached housing market. For sellers, it means pricing must be aggressive and presentation polished. For buyers, however, this is one of the few areas where real negotiating power exists—particularly for those with flexible timelines and a willingness to update a unit.

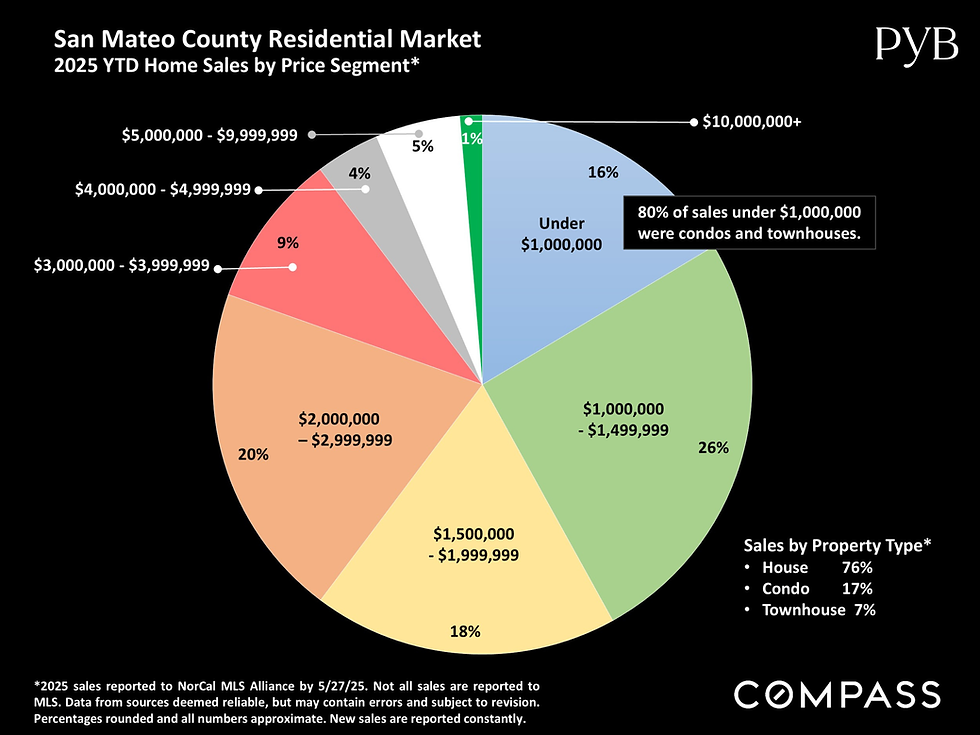

4. Detached vs. Attached: A Widening Gap as Houses Outpace Condos 7 to 1 in Price Growth

The performance gap between detached homes and attached housing has never been wider in San Mateo County. Since Spring 2020, single-family homes have appreciated by over 35%, while condos have managed only about 5% growth over the same five-year period. This massive divergence highlights how deeply buyer preferences have shifted toward space, privacy, and long-term flexibility.

This trend accelerated during the pandemic and shows no sign of reversing. Buyers—especially in the mid-tier and luxury segments—are prioritizing home offices, private yards, extra bedrooms, and long-term livability. Detached homes check those boxes, while many condos and townhouses fall short.

What’s more, buyers of detached homes tend to have deeper pockets—equity-rich, often working in tech or finance, and less sensitive to interest rates. These buyers can afford to stretch for the lifestyle benefits of a single-family home. In contrast, the typical condo buyer is navigating affordability limits and is more impacted by monthly costs like mortgage payments and HOA dues.

The result? Detached homes not only appreciate faster but also sell more quickly, face less pricing pressure, and receive more aggressive offers. Condos, on the other hand, are experiencing slower absorption, more price reductions, and increasing inventory buildup.

For sellers of detached homes, this is a market that still rewards quality listings in good locations. For condo sellers, it’s a different equation—success now depends on standout condition, competitive pricing, and savvy marketing.

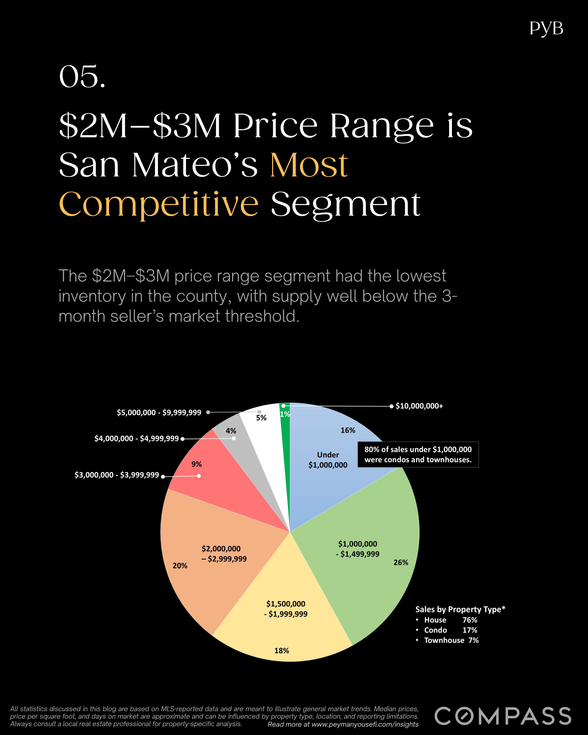

5. The $2M–$3M Segment Is the Hottest in San Mateo — Just 1.9 Months of Inventory

If there’s one price band where demand is far outpacing supply in San Mateo County, it’s the $2 million to $3 million range. As of June 1, 2025, this segment had the lowest Months Supply of Inventory (MSI) in the entire county—just 1.9 months. That’s well below the 3-month threshold typically used to define a seller’s market.

This tight inventory means that homes in this range are selling faster than they’re being listed, creating a highly competitive environment. Many of these properties are detached homes in central, sought-after neighborhoods—appealing to equity-rich buyers, often in the tech or biotech sectors, who are upgrading from smaller homes or relocating from more expensive areas.

These buyers typically come prepared—with strong down payments, stock wealth, or pre-approval letters in hand—and they’re ready to act quickly when the right home hits the market. On the flip side, sellers in this segment are often only listing if they have a compelling reason to move. That means new supply is limited, even as demand remains high.

This dynamic has turned the $2M–$3M tier into the most aggressive and competitive part of the San Mateo market. Homes here are often going into contract within days—especially if they’re priced well and located in strong school districts or near Caltrain or downtown corridors.

For sellers, it’s an opportune moment: if your home is in this range and in good showing condition, market timing is on your side. For buyers, be ready for multiple-offer scenarios, and consider preemptive or non-contingent offers if you’re serious about securing a property in this tier.

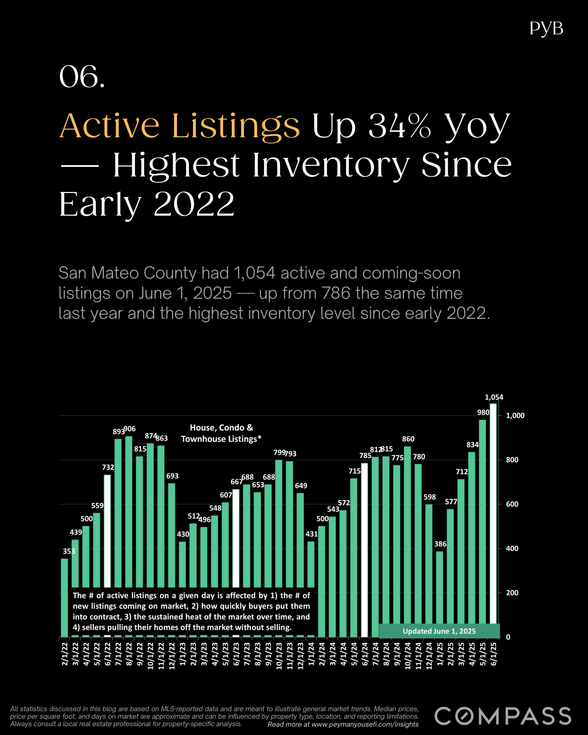

6. Active Listings Jump 34% Year Over Year — Highest Inventory Since Before the Pandemic

As of June 1, 2025, San Mateo County had 1,054 active and coming-soon listings, marking a 34% year-over-year increase and the highest inventory level in more than three years. This sharp rise in available homes is shifting the balance of power in some segments of the market—giving buyers more options and greater leverage, particularly for properties that are dated, overpriced, or slower to show well.

This inventory surge is being driven by a few converging trends:

More sellers re-entering the market, encouraged by spring seasonality and a recovering stock market.

Slower absorption rates, meaning listings are staying on the market longer.

An uneven buyer pool, with strong demand at the high end but more caution in the mid-tier and condo segments.

What’s important to note is that the rise in listings hasn’t been matched by a proportional rise in buyer activity. While serious buyers are still active—especially in the $2M–$3M range—many other segments are seeing homes linger, especially mid-tier condos or homes that need updating.

Detached single-family homes still make up the majority of listings (66%), but condos now account for over one-quarter of all active inventory. That puts pressure on sellers in the attached housing segment, where buyers are taking more time, comparing more options, and pushing back on pricing.

For sellers, this means it’s no longer enough to simply list—pricing, staging, and timing all matter more than ever. For buyers, especially those who were frustrated by tight supply in recent years, this is one of the best selection environments the county has seen since pre-pandemic times.

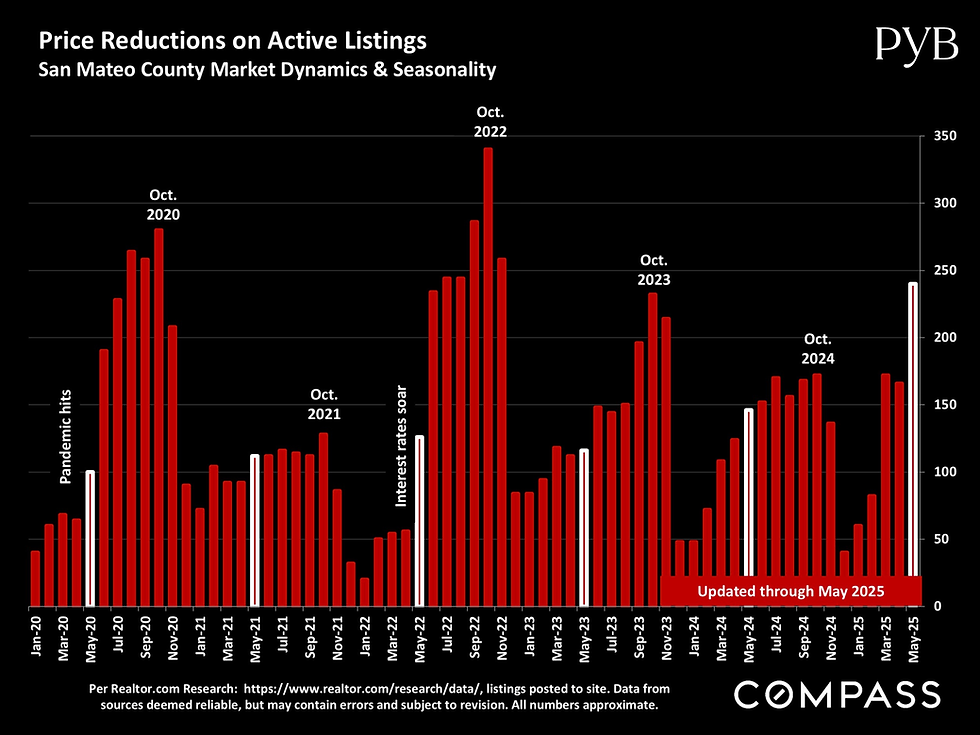

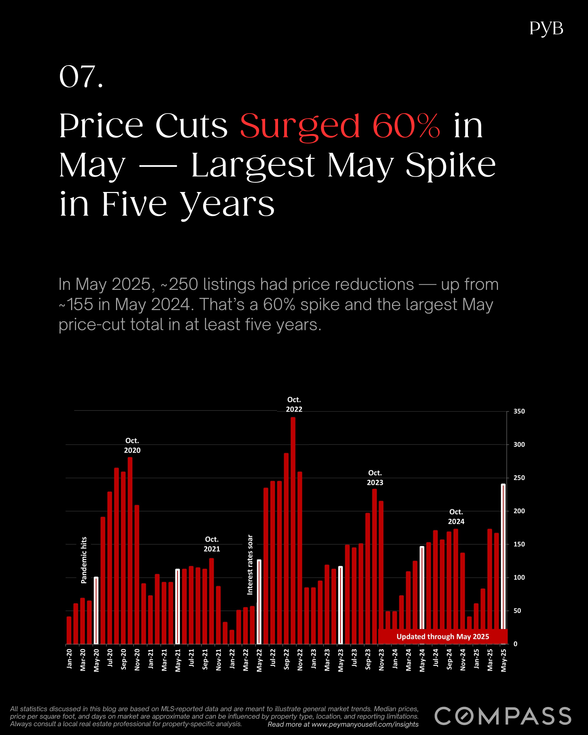

7. Price Cuts Surge 60% Year Over Year — Largest May Spike in Five Years

In May 2025, roughly 250 active listings in San Mateo County had their prices reduced—a 60% increase compared to May 2024 and the highest number of May price reductions in at least five years. This dramatic rise signals that many sellers are recalibrating expectations in response to a changing market dynamic: more listings, but not enough buyer urgency to absorb them all at previous price levels.

This wave of markdowns is directly tied to the 34% year-over-year inventory increase we saw heading into June. With more options available, buyers are getting choosier—and many are unwilling to engage with homes they perceive as overpriced. In response, sellers are adjusting, often just a few weeks after going live.

Price reductions were especially common among:

Mid-tier homes ($1M–$2M) that were priced optimistically in April or early May.

Condos, where affordability concerns and high monthly dues are making buyers more cautious.

Dated or underprepared listings that struggled to compete with better-presented alternatives.

This is not a sign of market collapse—it’s a sign of price discipline. Today’s buyers are value-focused, financially aware, and sensitive to both rates and monthly costs. Listings that don’t align with recent comps or don’t present well are now sitting longer or facing discounts to attract offers.

For sellers, the message is clear: price correctly from day one. Overpricing and then cutting later often results in longer time on market and weaker offers. For buyers, this trend opens up room for negotiation—especially on listings that have lingered for more than two or three weeks.

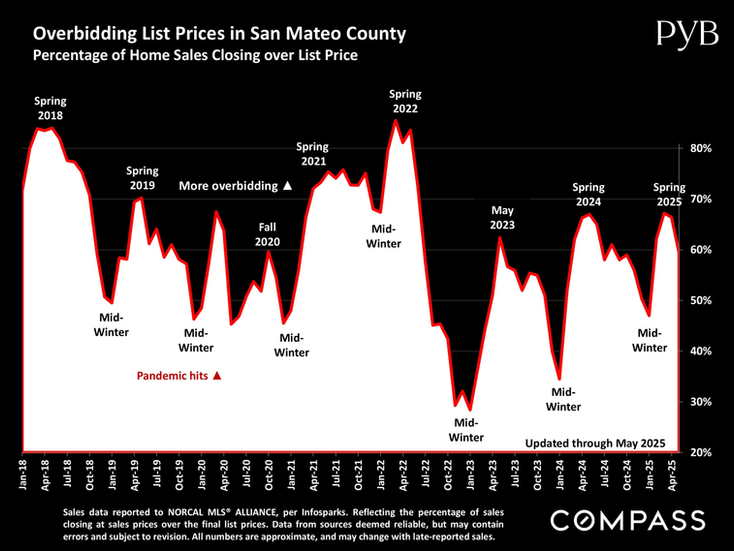

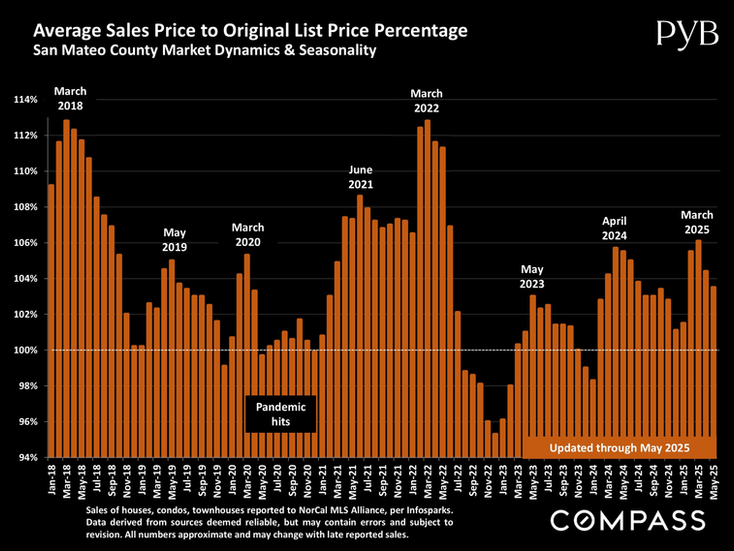

8. 60% of Homes Sold Over Asking in May — Competition Still Fierce for the Right Listings

Despite rising inventory and an increase in price reductions, buyer competition remains intense—especially for well-presented, accurately priced homes. In May 2025, 60% of all residential sales in San Mateo County closed above their original list price, a strong indicator that demand is still outpacing supply for high-quality properties. For detached single-family homes, the rate was even higher: 65% sold over asking, reflecting continued strength in the most desirable segments of the market.

This level of overbidding marks one of the strongest spring performances since the post-pandemic peak in 2022. Even with more listings available, buyers continue to show up aggressively for homes that check key boxes—location, condition, layout, and school district. The influx of new inventory has added options but not necessarily diluted competition. If anything, it has allowed buyers to focus their attention on the listings that truly stand out, often resulting in multiple-offer scenarios and escalation clauses for the most attractive properties.

At the same time, the market remains highly segmented. Condos, for example, saw much less aggressive bidding, with only about 33% of those units closing over list. This contrast underscores the importance of product type, pricing strategy, and presentation in today's market. The sharpest bidding wars are happening in the single-family segment, particularly in the $1M–$3M price band and in neighborhoods with strong school ratings or walkable amenities.

For sellers, these numbers reinforce that a well-prepared, market-aligned listing can still generate strong interest and exceed expectations. For buyers, the takeaway is clear: in many parts of the market, especially for move-in-ready homes, you’re still competing—often against multiple offers—and flexibility on price or terms may be necessary to win.

“Overbidding List Prices” and “Average Sales Price to Original List Price Percentage”

9. Homes Sold Twice as Fast Since Winter — But Spring Is Moving Slightly Slower Than in Past Years

The San Mateo housing market sped up dramatically this spring. In May 2025, the median Days on Market (DOM) fell to just 16 days, down from 44 days in January. That’s a huge seasonal rebound—homes are now selling nearly three times faster than they were just a few months ago.

But zooming out, there’s a subtle shift worth noting. This May’s DOM is slightly longer than prior spring markets. In Spring 2021 and Spring 2022, DOM hit 10–11 days, and even last year it was around 15. So while today’s market is still moving briskly, it’s not quite as frenzied as it was during the pandemic-era surges.

What this suggests is a more measured form of buyer urgency. Well-priced, updated homes in strong locations are still moving quickly, but buyers are also taking a bit more time to evaluate their options. That’s especially true in segments with more inventory or pricing uncertainty.

Single-family homes continue to sell fastest, while condos are still lagging, with longer DOM due to affordability ceilings, HOA fees, and shifting preferences toward detached living.

For sellers, this underscores the importance of strong first-week performance—homes that don’t generate traction early are far more likely to need price cuts. For buyers, it’s a market with more breathing room than 2021, but great listings still disappear fast.

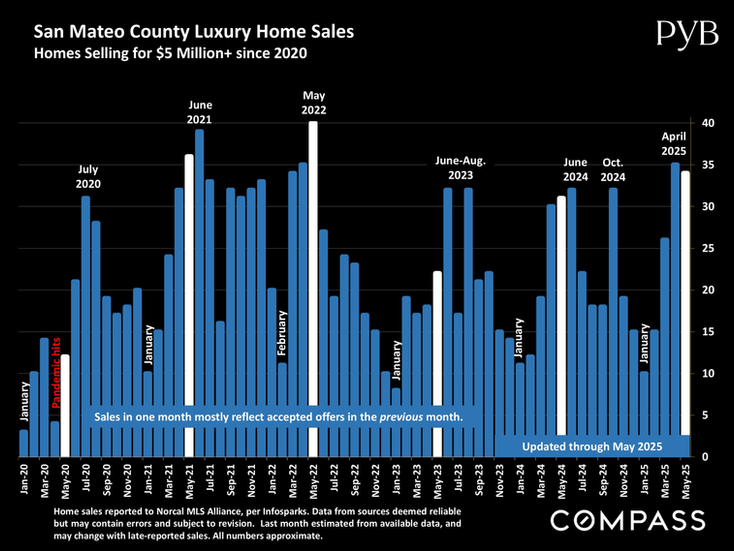

10. San Mateo’s Ultra-Luxury Market Remains One of the Most Competitive in the Bay Area

While some parts of the market have softened, San Mateo County’s ultra-luxury segment—homes priced at $5 million and above—continues to outperform. In May 2025, sales in this tier remained strong, building on April’s momentum and ranking among the highest spring volumes since the 2022 peak. Wealthy buyers are clearly still active, and the pace at which these properties are selling underscores the depth of demand at the very top of the market.

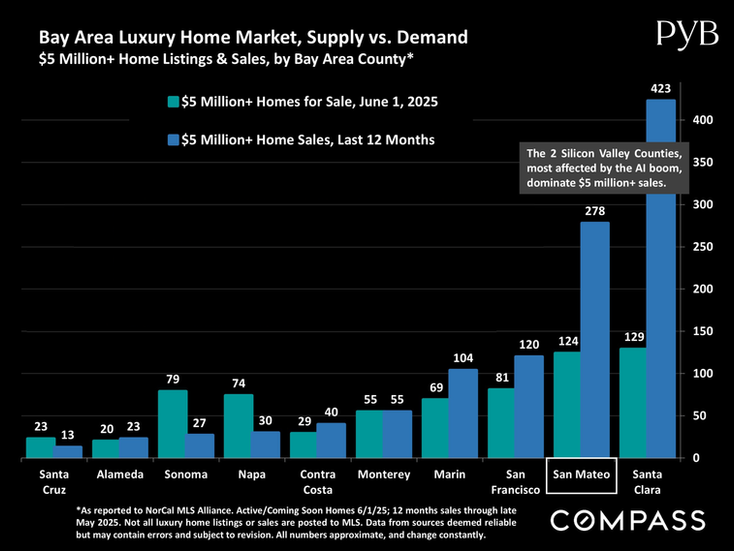

Over the past 12 months, San Mateo recorded 278 closed sales in the $5M+ range, and as of June 1, there were only 124 such listings available. That results in an inventory-to-sales ratio of just 45%, meaning there are fewer than 50 active listings for every 100 luxury sales over the past year. By comparison, other counties like Napa and Sonoma are seeing ratios in the 200%–300% range, highlighting San Mateo’s tight supply and fast-moving high-end inventory.

This performance is largely driven by San Mateo’s unique mix of location, lifestyle, and economic connectivity. Cities like Hillsborough, Atherton, and select parts of Menlo Park and Burlingame attract buyers from venture capital, tech, and finance—many of whom are cash-ready, insulated from mortgage rate pressures, and seeking properties with privacy, prestige, and long-term investment value.

For sellers, this is one of the strongest environments in the region. Well-positioned luxury homes—especially those with architectural significance, new construction, or exceptional lots—are commanding top dollar with relatively short market times. For buyers, it’s a highly competitive segment where preparation, speed, and strong negotiation strategy are essential.

📊 Chart Reference: “San Mateo County Luxury Home Sales ($5M+)” and “Bay Area Luxury Home Market: Supply vs. Demand ($5M+ Listings & Sales)” – These charts together show the strong pace of luxury transactions and San Mateo’s exceptionally tight supply-demand ratio in the high-end market.

“San Mateo County Luxury Home Sales ($5M+)” and “Bay Area Luxury Home Market: Supply vs. Demand ($5M+ Listings & Sales)”

Last Words

San Mateo County’s housing market is entering a more selective and segmented phase. While some areas—particularly condos and mid-tier attached homes—are seeing softer conditions, demand remains strong at the high end and for well-located, move-in-ready single-family homes. Inventory is up, competition is still sharp in key segments, and buyer behavior is increasingly shaped by lifestyle priorities, value perception, and price discipline.

Whether you’re buying, selling, or simply observing, the key in this market is understanding the nuance. Timing still matters—but so do condition, pricing strategy, and how your property stacks up within its price band.

Note: All statistics cited in this blog are based on MLS-reported data and are meant to illustrate general trends in San Mateo County as of June 2025. Median prices, inventory levels, and absorption metrics may vary by neighborhood and property type. Always consult with a local real estate expert for home-specific guidance.

Comments