9 Takeaways from Santa Clara County’s Housing Market – July 2025

- Peyman Yousefi

- Jul 11, 2025

- 10 min read

The July 2025 housing data from Santa Clara County shows a market that’s shifting — but not slowing. After a frenzied spring capped by record-breaking prices, we’re now seeing the first signs of buyer fatigue, inventory plateauing, and seller expectations being tested. Yet beneath the surface, the story is more complex than a simple “cooldown.”

Luxury homes are still flying off the market, often with all-cash offers. Entry-level condos, meanwhile, are struggling with declining prices and longer days on market. In the middle, townhouses and $2M–$3M homes are facing affordability headwinds, while still attracting serious — but more cautious — buyers.

The overall picture? Santa Clara’s housing market remains one of the most competitive and resilient in the Bay Area, but it’s evolving. Sellers can’t overreach. Buyers can’t afford to wait too long in desirable submarkets. And everyone needs to understand how the balance between price, demand, and strategy is shifting in real time.

In this post, I break down the 9 most important takeaways from the latest MLS data — all focused specifically on Santa Clara County — to help you navigate this next chapter in our local market.

Before we dive in, the carousel below offers a quick visual snapshot of the 9 key takeaways.

1. Santa Clara County Home Prices Hit a New All-Time High in Q2 2025

In Q2 2025, Santa Clara County’s median single-family home price reached a new record: $2.115 million, marking a 6% increase year-over-year from Q2 2024. This milestone reinforces the county’s long-term price leadership and shows that even amid rising inventory and rate-sensitive buyers, demand in core submarkets remains exceptionally strong.

The Q2 spike wasn’t just seasonal noise. Historically, spring tends to be the strongest quarter for pricing due to buyer urgency and tight inventory. But this year’s price performance exceeded even the aggressive gains of the 2021–2022 pandemic boom. Neighborhoods like Palo Alto, Cupertino, and Los Altos continue to attract well-capitalized buyers — often from the AI and tech sectors — who are less sensitive to interest rate fluctuations and more focused on location, school districts, and quality of life.

This chart also shows just how far the market has come since the short-lived correction in early 2023. After briefly dipping during that high-rate adjustment period, prices resumed their climb in late 2023 and have steadily moved upward throughout 2024 and into 2025.

For sellers, this record confirms strong pricing power — particularly for move-in-ready homes in top-tier locations. For buyers, it’s a reminder that waiting for a meaningful price drop in the most desirable areas may not be a winning strategy.

2. Luxury Market Breaks Records — $5M+ Sales Hit Highest Level Ever

Santa Clara County’s luxury housing market just made history. In Q2 2025, 149 homes sold for $5 million or more, making it the highest quarterly total ever recorded for this price tier in the county — even surpassing the frenzied peaks of the 2021–2022 pandemic boom.

This isn’t just a seasonal uptick. It’s the result of deep, structural demand from a growing class of high-net-worth buyers tied to AI, biotech, and other tech-adjacent sectors. Many of these transactions are happening off-market or with minimal financing — often backed by stock grants, IPO windfalls, or equity-rich trade-ups. That means this segment is largely insulated from mortgage rate volatility, which continues to dampen activity in the mid and entry-level markets.

Unlike the broader market, where buyers are negotiating more and sellers are adjusting expectations, the luxury tier remains highly competitive. Homes in Palo Alto, Los Altos Hills, and parts of Saratoga are still commanding premium prices, short days on market, and frequent multiple-offer scenarios.

For sellers in this bracket, Q2’s record performance is a green light — this is one of the most favorable environments seen in years. For buyers, it’s a reminder that in the upper echelon of Silicon Valley real estate, waiting for a “deal” often means missing the right opportunity.

3. The Middle Tier Stalls — Townhouse Prices Flat for a Fourth Straight Quarter

While the luxury segment continues to surge, the townhouse market is showing signs of stagnation. In Q2 2025, the median townhouse price in Santa Clara County remained flat at $1.30 million, unchanged from the same quarter a year ago. This marks the fourth consecutive quarter with little to no movement — a clear sign that mid-tier affordability ceilings are holding prices in check.

Townhouses sit at the intersection of affordability and livability. They’re a popular choice for move-up buyers, dual-income households, and those priced out of detached homes. But this segment is especially sensitive to monthly payment dynamics, and with mortgage rates still hovering near 7%, many buyers simply can’t stretch further — especially when factoring in HOA dues.

Unlike the $2M–$3M single-family segment, which remains highly competitive in top school zones, the townhouse market has seen less urgency, longer days on market, and more selective buyer behavior. The result? A pricing plateau. Sellers who aren’t strategic about prep, staging, or pricing are often sitting longer or facing offers below asking.

For buyers, however, this could present a short-term opportunity — especially for well-maintained units in good locations. For sellers, it’s a reminder that while demand exists, success in this segment requires sharper positioning than in years past.

4. Condo Market Declines 6.5% YoY — Entry-Level Segment Under Pressure

While single-family homes and luxury properties are setting records, Santa Clara’s condo market is quietly slipping. In Q2 2025, the median condo price dropped to $770,000, down 6.5% year-over-year — the sharpest decline of any major property type this quarter.

This trend highlights a growing affordability divide in the market. Condos are traditionally the entry point for first-time buyers, downsizers, and investors — but this segment is being squeezed from multiple sides. High mortgage rates, rising HOA dues, and competition from increasingly attractive rental options have all dampened buyer enthusiasm.

In fact, condo prices have remained largely stagnant for the past five years. Even during the AI-fueled rebound that lifted the rest of the market in 2023 and 2024, condos failed to gain meaningful momentum. And now, with demand softening and inventory building, sellers are being forced to cut prices or wait longer for offers.

The result? Longer days on market, fewer bidding wars, and more negotiation power for buyers — particularly on units that lack updates or are in less walkable neighborhoods. For sellers, the message is clear: this is no longer a market where anything sells. Pricing strategy, presentation, and location matter more than ever.

5. Absorption Rate Hits 6-Year Low — Just 50% of Listings Go into Contract

In Q2 2025, only 50% of listings in Santa Clara County went into contract, down sharply from 63% during the same period last year. This marks the lowest second-quarter absorption rate since 2019, signaling a meaningful shift in market balance — and a clear slowdown in buyer urgency.

The absorption rate reflects the share of active listings that convert to pending sales within the same quarter. When it’s high, the market is hot. When it drops, it means inventory is building faster than it’s being absorbed. And that’s exactly what’s happening now. Even though prices remain elevated and demand still exists, many buyers are taking longer to commit, submitting more conditional offers, or holding off altogether.

Why the hesitation? Several factors are at play:

Mortgage rates remain in the mid-to-high 6% range.

Buyer fatigue is rising after a competitive spring.

Some buyers are waiting for price reductions — or clearer economic signals.

The result is a more selective and value-driven market, especially outside of high-demand school zones or prime locations. Homes that are priced ambitiously or need work are sitting longer, while move-in-ready properties are still moving — but not with the same velocity we saw even a year ago.

For sellers, this is a critical inflection point. If your home doesn’t stand out in price, presentation, or location, it may linger. For buyers, the growing gap between listings and sales could offer better leverage this summer — especially on homes that didn’t sell in spring.

6. Buyer Competition Eases — Overbidding Rate Drops to 56%

After several years of frenzied bidding wars, buyer competition in Santa Clara County is clearly moderating. In June 2025, only 56% of homes sold above asking price, down significantly from 73% in June 2024. This is one of the most visible signs that the market is shifting from overheated to more balanced — even as prices remain high.

Overbidding still happens, particularly for updated homes in top-tier school districts. But the average buyer today is more selective, and more sensitive to both price and value. Many are submitting offers closer to asking, asking for contingencies, or passing altogether on homes that aren’t turnkey.

Supporting this trend, the average sale-to-list ratio also dropped, from 106% last June to just 102% this year. That means the average home is still selling slightly above list — but the gap has narrowed substantially, especially outside of the most desirable neighborhoods.

The biggest pullback is visible in the condo market, where only 37% of sales closed over asking. By contrast, 59% of houses and townhomes still sold above list — showing that competition remains, but it’s more price-dependent and property-specific than before.

For sellers, the message is clear: bidding wars are no longer guaranteed. Proper pricing is essential, and overreaching on list price could lead to stagnation. For buyers, this is the most navigable market in years — one where strong homes still go quickly, but the broader climate allows more breathing room and better negotiation opportunities.

Overbidding % and Sale-to-List Ratio – June 2025

7. Inventory Rises 31% YoY — But Begins to Plateau in July

After several months of rising inventory, Santa Clara County saw its first slight dip in active listings in July, signaling a possible plateau in new seller activity. As of July 1, 2025, there were 2,239 homes actively listed or marked “coming soon”, down modestly from June and May — but still 31% higher than July 2024.

This inventory surge began early in the spring when many homeowners sensed an opportunity to capitalize on high prices. March 2025 saw the biggest wave of new listings in over two years. But as the season progressed, and as buyer activity showed signs of softening, the listing momentum faded. By July, the market had cooled just enough to prompt some would-be sellers to hit pause.

Interestingly, this inventory buildup hasn’t translated into excess supply — yet. Compared to pre-pandemic norms, overall listing volume is still relatively tight, especially in desirable school zones and central neighborhoods. But compared to 2023 or even early 2024, buyers now have more choices and more negotiating leverage.

The composition of active inventory also matters:

60% are single-family homes, where pricing power remains firm — but competitive.

25% are condos, where prices are declining.

15% are townhouses, where activity has plateaued.

For buyers, this may be one of the best selection windows of the year, especially if interest rates edge down later in the summer. For sellers, it’s a more crowded playing field — and standing out will require more than just a strong location.

Active & Coming-Soon Listings – July 1, 2025 & New Listings Coming on Market (2021–2025)

8. Price Reductions Spike 93% YoY — Market Testing Seller Expectations

In June 2025, over 650 active listings in Santa Clara County had price reductions, marking a 93% increase year-over-year — and the highest June tally since the post-rate-spike wave of summer 2022. This is one of the clearest signs that sellers are adjusting to a more price-sensitive market.

The timing of this spike is no coincidence. As inventory climbed through the spring, many sellers listed with ambitious price targets — hoping to ride the momentum from earlier record-setting sales. But as buyer competition eased, it became apparent that homes not priced correctly from the outset were sitting longer, prompting markdowns.

This shift has been especially pronounced in:

Condos and townhomes, where affordability ceilings and HOA dues create buyer friction.

Mid-tier properties with cosmetic or functional flaws, which now face greater scrutiny.

Overconfident listings in even strong submarkets, where buyers are willing to wait for value.

For sellers, this is a moment for strategic realism: the days of listing high and letting the market catch up are over — at least for now. Homes that are priced right and show well can still attract strong offers. But misaligned pricing is quickly punished, as buyers now have more options and are less likely to compete aggressively.

For buyers, the rise in price reductions presents a real opportunity — especially on listings that have been sitting since May or longer. These homes may be open to negotiation on both price and terms, particularly if sellers are watching nearby comps go under contract first.

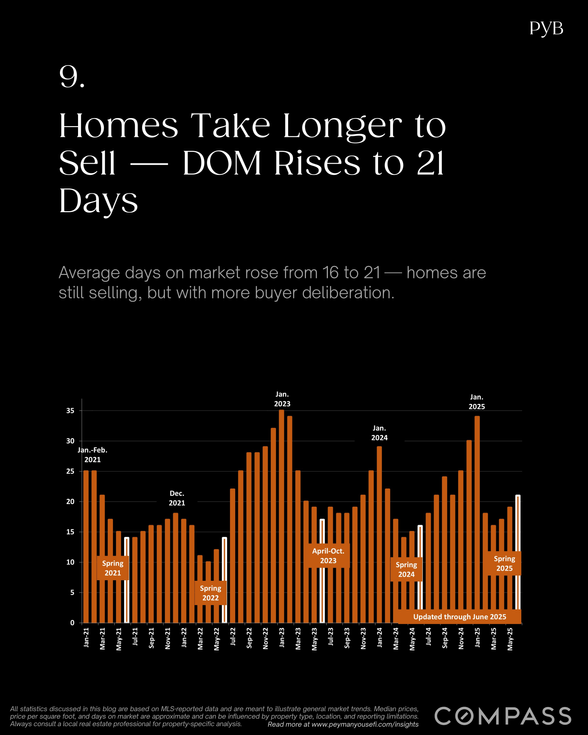

9. Homes Take Longer to Sell — DOM Rises to 21 Days

In June 2025, the average Days on Market (DOM) for Santa Clara County rose to 21 days, up from 16 days a year ago. While three weeks is still a relatively fast selling pace by historical standards, the increase points to a clear softening in buyer urgency — especially compared to the hyper-competitive spring markets of recent years.

The breakdown by property type shows how this cooling trend is playing out:

Single-family homes averaged 19 days on market

Townhomes: 23 days

Condos: 31 days — the slowest moving segment

In earlier spring seasons (like 2021 or 2022), homes often went pending in under 10 days, particularly in top-tier school zones. This year, buyers are taking more time. They’re comparing options, negotiating more, and acting selectively — especially as inventory has grown and the overbidding frenzy has cooled.

This shift doesn’t mean demand is gone. It means the market has moved from “instant” to “strategic”. Well-priced, move-in-ready homes are still selling quickly. But listings that are overpriced, underprepared, or in less desirable locations are sitting longer — often requiring price cuts to generate traction.

For sellers, this underscores the importance of timing, condition, and pricing. For buyers, it offers a slightly more balanced environment where you can slow down just enough to make thoughtful decisions — and even negotiate when appropriate.

Last Words

Santa Clara County’s housing market remains one of the most resilient and dynamic in the Bay Area — but it’s evolving. Prices are still rising, especially in the luxury segment, and buyer demand hasn’t disappeared. Yet the signs of a shift are clear: inventory is growing, price reductions are climbing, and homes are sitting slightly longer as buyers become more cautious and selective.

This isn’t a market crash — far from it. It’s a recalibration. The ultra-high end continues to break records, fueled by cash-rich buyers and tech wealth. At the same time, the entry-level condo market is softening, and even mid-tier homes are facing more scrutiny than in past seasons. Across the board, strategy is replacing speed — and that’s changing how deals get done.

If you're thinking about selling, it’s more important than ever to price right from the start, prepare your home carefully, and understand what today’s buyers value. If you're a buyer, this is a window where you may have more leverage than you think — especially for properties that missed the spring wave.

As always, local knowledge and real-time data matter. The Santa Clara market isn’t cooling down — it’s getting smarter. And in a smarter market, well-informed decisions make all the difference.

Note: All statistics discussed in this blog are based on MLS-reported data and are meant to illustrate general market trends. Median prices, price per square foot, and days on market are approximate and can be influenced by property type, location, and reporting limitations. Always consult a local real estate professional for property-specific analysis.

Comments